Tamu Sales Tax Exempt Form

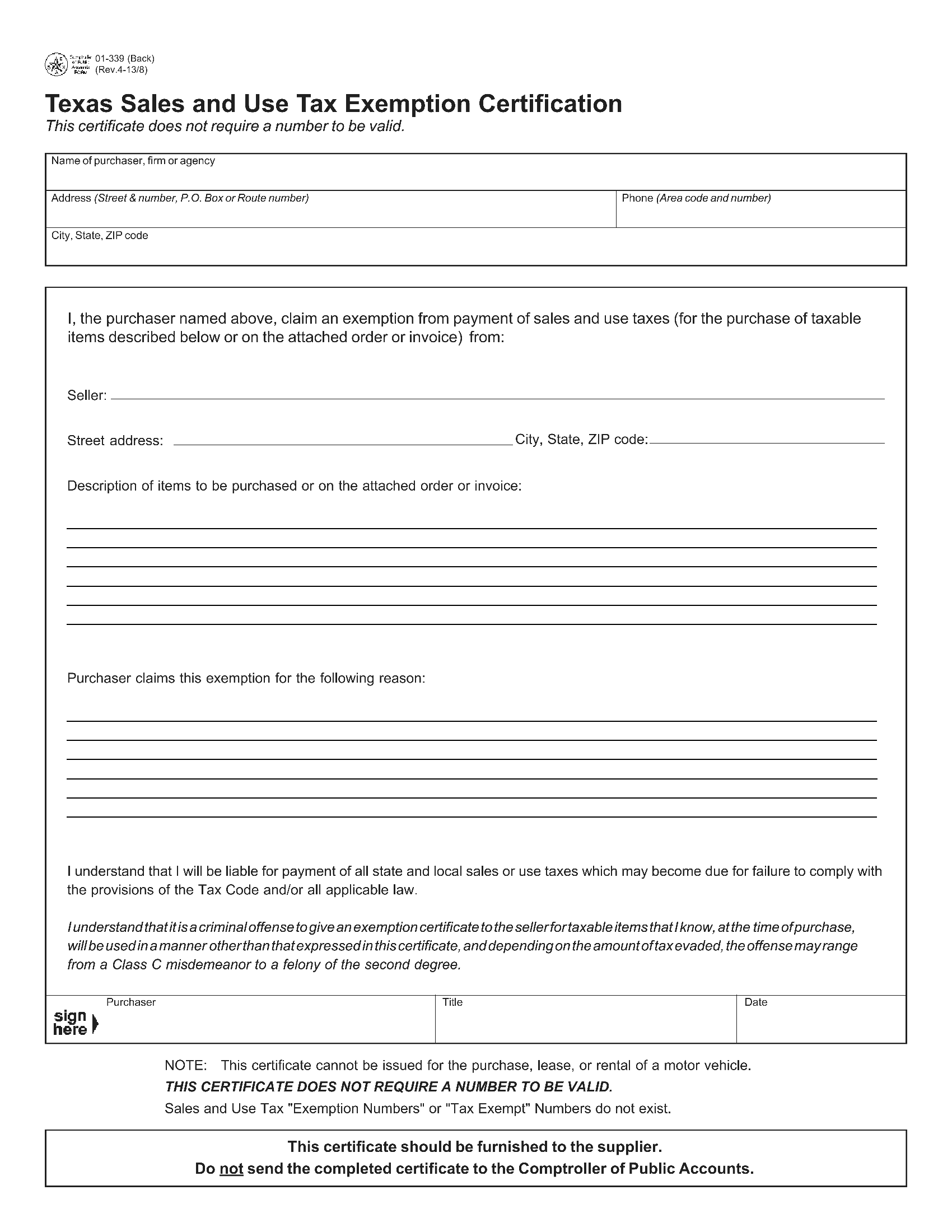

Tamu Sales Tax Exempt Form - Phone area code & number: 17421252251 city, state, zip code: Products & services expand menu. The system members, as agencies of the state of texas, are tax exempt and the credit card identifies the system members as being tax exempt within. We are exempt from paying texas. Ad download tables for tax rate by state or look up sales tax rates by individual address. Rate tables and calculator are available free from avalara. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Web sales tax and other use taxes. Web reduction to expenditure instructions and form. Rate tables and calculator are available free from avalara. Hotel occupancy tax exemption form. Web for certain business situations, transactions are not subject to tpt. Ad download tables for tax rate by state or look up sales tax rates by individual address. The system members, as agencies of the state of texas, are tax exempt and the credit card identifies. The purpose of the certificate is to document and. Hotel occupancy tax exemption form. Ad collect and report on exemption certificates quickly to save your company time and money. I, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the. Web sales and use tax. I, the purchaser named above, claim an exemption from payment of sales and use taxes for. Streamline the entire lifecycle of exemption certificate management. Web the texas university system t e comptroller of public x accounts form. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state. Web texas sales and use tax exemption certificate. The purpose of the certificate is to document and. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. Tamu is exempt from the payment of florida sales and use tax on real property rented, transient rental property. Hotel occupancy tax exemption form. Ad collect and report on exemption certificates quickly to save your company time and money. The purpose of the certificate is to document and. Name of purchaser, firm or agency. Web texas sales and use tax exemption certification. All purchases of texas a&m university, texas a&m university galveston or texas a&m system offices: Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice. Products & services expand menu. Box or route number) phone (area code and. Web. Box or route number) phone (area code and. All purchases of texas a&m university, texas a&m university galveston or texas a&m system offices: Products & services expand menu. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Address (street & number, p.o. This certificate is prescribed by the department of revenue pursuant to a.r.s. We are exempt from paying texas. All purchases of texas a&m university, texas a&m university galveston or texas a&m system offices: Web sales tax and other use taxes. Web tamu and tamug travel forms. Web the texas university system t e comptroller of public x accounts form. Streamline the entire lifecycle of exemption certificate management. Web do not pay texas sales tax! Ad collect and report on exemption certificates quickly to save your company time and money. Web sales and use tax. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice. Name of purchaser, firm or agency. Address (street & number, p.o. Sales and use tax blanket exemption certificate. I, the purchaser named above, claim an exemption from payment of. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. Web texas sales and use tax exemption certification. I, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the. Name of purchaser, firm or agency. Phone area code & number: Ad download tables for tax rate by state or look up sales tax rates by individual address. Web sales and use tax returns and instructions. Ad collect and report on exemption certificates quickly to save your company time and money. 17421252251 city, state, zip code: Rate tables and calculator are available free from avalara. The system members, as agencies of the state of texas, are tax exempt and the credit card identifies the system members as being tax exempt within. Web do not pay texas sales tax! Web reduction to expenditure instructions and form. This certificate should be kept on file by the selling. Rate tables and calculator are available free from avalara. Web real property sales.

Fillable Form Dr 0563 Sales Tax Exemption Certificate Multi

ohio sales tax exemption form reasons Edmundo Dukes

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Texas Sales and Use Tax Exemption Certification Forms Docs 2023

Texas sales tax exemption form Fill out & sign online DocHub

Tx Form Sales Tax Exemption Fill Online, Printable, Fillable, Blank

FREE 10+ Sample Tax Exemption Forms in PDF

Tamu Registration Worksheet

michigan use tax exemption form Puissant Bloggers Pictures

Web Sales And Use Tax.

This Certificate Is Prescribed By The Department Of Revenue Pursuant To A.r.s.

I, The Purchaser Named Above, Claim An Exemption From Payment Of Sales And Use Taxes For.

Box Or Route Number) Phone (Area Code And.

Related Post: