Kansas Tax Form

Kansas Tax Form - Web kansas income tax withheld. Web forms travel card. Web individual tax return form 1040 instructions; Request for taxpayer identification number (tin) and certification form. Kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of revenue. Complete, edit or print tax forms instantly. Kansas income tax forms are available by calling or visiting our office (office location information here). Web servicemember civil relief act. Web 2 days agothe city of girard, kansas will be hosting a public form regarding a proposed 1/2 cent public safety sales tax that will appear on the ballot in november. If too little is withheld, you will generally owe tax when. Web servicemember civil relief act. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns online for free through any. What do i need to file? You can complete the forms with the help of efile.com free. Kansas income tax forms are available by calling or visiting our office (office location information here). Web the kansas tax forms are listed by tax year below and all ks back taxes for previous years would have to be mailed in. Web this. Web who can use webfile for an income tax return? Web servicemember civil relief act. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web forms travel card. What should i do if my address changed since i. You can complete the forms with the help of efile.com free. What do i need to file? Web those with an income greater than $73,000 can use the irs’s free fillable forms, which are electronic federal tax forms equivalent to the paper 1040 form. If too little is withheld, you will generally owe tax when. What should i do if. File your state taxes online; Web kansas income tax withheld. Add lines 8 & 11; Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Web who can use webfile for an income tax return? Web do not send the kansas department of revenue a copy of your form. Kansas state income tax rate: Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. You can complete the forms with the help of efile.com free. This. Prepare, efile ks + irs tax return. Web kansas income tax withheld. 5.70% estimate your ks income taxes now. Kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of revenue. Click on any header in the table below to sort the forms by that topic, or use the search. These 2021 forms and more are available: Web do not send the kansas department of revenue a copy of your form. Web those with an income greater than $73,000 can use the irs’s free fillable forms, which are electronic federal tax forms equivalent to the paper 1040 form. You can complete the forms with the help of efile.com free. If. Web do not send the kansas department of revenue a copy of your form. 5.70% estimate your ks income taxes now. Web servicemember civil relief act. Web those with an income greater than $73,000 can use the irs’s free fillable forms, which are electronic federal tax forms equivalent to the paper 1040 form. Web forms travel card. Individual income tax kansas itemized deductions. Web who can use webfile for an income tax return? File your state taxes online; Web individual tax return form 1040 instructions; Web forms travel card. Kansas income tax forms are available by calling or visiting our office (office location information here). Submit request begin the process of requesting a new tax clearance view status view the status of a. If you make $70,000 a year living in kansas you will be taxed $11,373. These 2021 forms and more are available: File your state taxes online; We offer a variety of software related to various fields at great prices. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. If too little is withheld, you will generally owe tax when. Web servicemember civil relief act. Web forms travel card. Ad get deals and low prices on turbo tax online at amazon. Complete, edit or print tax forms instantly. Who can use webfile for a homestead refund claim? You can complete the forms with the help of efile.com free. Web 2 days agothe city of girard, kansas will be hosting a public form regarding a proposed 1/2 cent public safety sales tax that will appear on the ballot in november. Web to obtain information regarding your current year income tax or homestead refund, it is essential that you enter your correct social security number and exact refund amount.

Form K230 2019 Fill Out, Sign Online and Download Fillable PDF

Kansas City Earnings Tax Form Rd 109 Fill Out and Sign Printable PDF

Fillable Form K120 Kansas Corporation Tax 2012 printable

Fillable Form K40es Kansas Individual Estimated Tax Voucher

KS K40PT 20202022 Fill and Sign Printable Template Online US

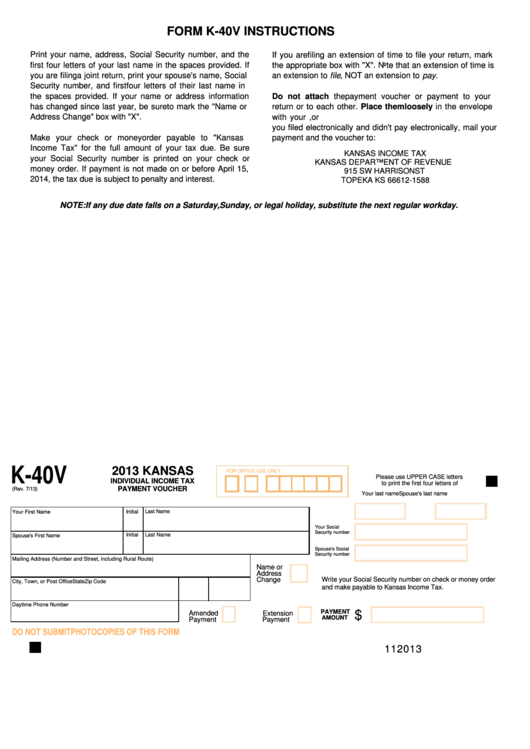

Fillable Form K40v Kansas Individual Tax Payment Voucher

Fillable Form K40es Individual Estimated Tax Kansas Department Of

Form K120 Kansas Corporation Tax 2004 printable pdf download

DO 41 Request for Copy of Kansas Tax Documents or Access Rev 7 14 Copy

Fillable Form K210 Kansas Individual Underpayment Of Estimated Tax

Web Webfile Is An Online Application For Filing Kansas Individual Income Tax Return That Is Fast And Paperless Way To File, And Refunds Can Be Deposited Directly Into Your Bank Account

Web This Workshop Covers Kansas Withholding, Estimated Taxes, Sales And Compensating Use Taxes.

Request For Taxpayer Identification Number (Tin) And Certification Form.

Kansas Has A State Income Tax That Ranges Between 3.1% And 5.7% , Which Is Administered By The Kansas Department Of Revenue.

Related Post: