Kansas Form K 40

Kansas Form K 40 - Web kansas only tax return the irs. Enter the total number of exemptions in the total kansas exemptions box. Kansas — individual income tax return. You must be a kansas resident and have a valid social security number for all individuals on your return. You can download or print current. Important information for the current tax year. The credit allowed for tax. 1) your kansas income tax balance due, after. Web how to file your estimated tax. Enter the result here and. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Get ready for tax season deadlines by completing any required tax forms today. Kansas — individual income tax return. Web credit may reduce your kansas tax liability. Important —if you are claimed as a dependent by another taxpayer, enter “0” in. Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. The credit allowed for tax. Get ready for tax season deadlines by completing any required tax forms today. 1) your kansas income tax balance due, after. Please use the link below. Kansas income tax, kansas dept. It appears you don't have a pdf plugin for this browser. Web adjusted gross income chart for use tax computation. Enter the result here and on line 18 of. Get ready for tax season deadlines by completing any required tax forms today. Web adjusted gross income chart for use tax computation. Web kansas only tax return the irs. Enter the total number of exemptions in the total kansas exemptions box. Kansas income tax, kansas dept. Web credit may reduce your kansas tax liability. Web how to file your estimated tax. Enter on line 8 of. Estimated tax payments are required if: Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. Get ready for tax season deadlines by completing any required tax forms today. Enter the result here and. Enter the result here and on line 18 of. Filing status (mark one) residency status (mark one) exemptions. Do not send the kansas department of revenue a copy of your form. Web how to file your estimated tax. Web kansas only tax return the irs. Please use the link below. Estimated tax payments are required if: Enter the result here and on line 18 of. You must be a kansas resident and have a valid social security number for all individuals on your return. Web how to file your estimated tax. Enter on line 8 of. Get ready for tax season deadlines by completing any required tax forms today. To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers. Kansas income tax, kansas dept. 1) your kansas income tax balance due, after. Estimated tax payments are required if: To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers. Web if this is an amended 2018 kansas return mark one of the following boxes: Please use the link below. Kansas — individual income tax return. Filing status (mark one) residency status (mark one) exemptions. Web credit may reduce your kansas tax liability. Enter the result here and. Enter the result here and on line 18 of. Enter on line 8 of. Kansas — individual income tax return. 1) your kansas income tax balance due, after. Web credit may reduce your kansas tax liability. Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. Answer only the questions that apply to you. You can download or print current. Web adjusted gross income chart for use tax computation. To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers. Web if this is an amended 2018 kansas return mark one of the following boxes: Important information for the current tax year. Kansas income tax, kansas dept. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Please use the link below. You must be a kansas resident and have a valid social security number for all individuals on your return. Filing status (mark one) residency status (mark one) exemptions.

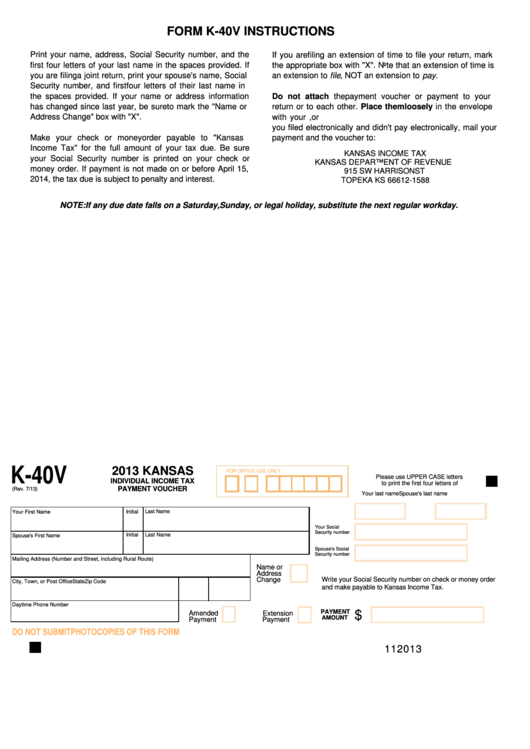

Fillable Form K40v Kansas Individual Tax Payment Voucher

Kansas k40 form Fill out & sign online DocHub

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Form K40h Kansas Homestead Claim 2010 printable pdf download

Kansas k4 form 2019 Fill out & sign online DocHub

K40 2012 Kansas Individual Tax printable pdf download

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012

2015 Form KS DoR K40Fill Online, Printable, Fillable, Blank pdfFiller

Single Resident Number Of Exemptions Claimed On Your 2003 Federal.

Enter The Result Here And On Line 18 Of.

Enter The Result Here And.

Important —If You Are Claimed As A Dependent By Another Taxpayer, Enter “0” In The.

Related Post: