Iowa Extension Form

Iowa Extension Form - If you owe ia income taxes, you will either have to submit a ia tax. Web if the result is equal to or less than the amount on line 66 of the ia 1040, an extension is automatic. The actual due date to file form ia 1040 is april 30 or by the 30th day of the 4th month after the tax year. The department does not have an extension form to obtain additional time to file. If at least 90% of your total tax liability is. If at least 90% of your total tax liability is. Web extended deadline with iowa tax extension: Web the department does not have an extension form to obtain additional time to file. This file type is our preferred format for creating and updating digitally. Web you can make an iowa extension payment with form ia 1040v, or pay electronically using iowa’s efile & pay system: If at least 90% of your total tax. If at least 90% of your total tax liability is. Web you can make an iowa extension payment with form ia 1040v, or pay electronically using iowa’s efile & pay system: Download or email ia 1040 & more fillable forms, register and subscribe now! Web 2021 the department does not have an. Easypay iowa or via aci payments. Pay all or some of your iowa income taxes online via: Iowa personal income tax returns are due by april 18. Web if the result is equal to or less than the amount on line 66 of the ia 1040, an extension is automatic. $5,000 x 90% = $4,500. If you owe ia income taxes, you will either have to submit a ia tax. Download or email ia 1040 & more fillable forms, register and subscribe now! If you cannot file by that date, you can get a state tax extension. Web common questions about iowa extensions in lacerte. Web october 18, 2023 3:14 pm. Web 1 year authority full administration authority for the grade levels and endorsements listed on the license. If at least 90% of your total tax liability is. Web this form can provide the owner or operator with a guide for developing a termination notice to fit their individual situation. Web the department does not have an extension form to obtain. If at least 90% of your total tax liability is. Web new for 2022 mandatory electronic filing. If at least 90% of your total tax liability is. Download or email ia 1040 & more fillable forms, register and subscribe now! The actual due date to file form ia 1040 is april 30 or by the 30th day of the 4th. If at least 90% of your total tax liability is. For most americans, filing deadlines for 2022. Complete, edit or print tax forms instantly. A federal extension does not apply for iowa purposes. Web the department does not have an extension form to obtain additional time to file. If you owe ia income taxes, you will either have to submit a ia tax. Web this form can provide the owner or operator with a guide for developing a termination notice to fit their individual situation. Web october 18, 2023 3:14 pm. Web if the result is equal to or less than the amount on line 66 of the. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. A federal extension does not apply for iowa purposes. Through campus and regional specialists and staff in 100 county extension offices, iowa. If you owe ia income taxes, you will either have to submit a ia tax. If at least. A federal extension does not apply for iowa purposes. Iowa personal income tax returns are due by april 18. Web the department does not have an extension form to obtain additional time to file. This file type is our preferred format for creating and updating digitally. Web new for 2022 mandatory electronic filing. If at least 90% of your total tax liability is. A federal extension does not apply for iowa purposes. Web accessible adobe pdf forms. A federal extension does not apply for iowa purposes. Web the department does not have an extension form to obtain additional time to file. Pay all or some of your iowa income taxes online via: Web with the irs announcing january 23 as the first date for accepting 2022 tax returns, the 2023 tax season is now open. If at least 90% of your total tax liability is. Web accessible adobe pdf forms. The actual due date to file form ia 1040 is april 30 or by the 30th day of the 4th month after the tax year. If at least 90% of your total tax liability is. This form is not intended to take the place of legal advice. The department does not have an extension form to obtain additional time to file. A federal extension does not apply for iowa purposes. Web the department does not have an extension form to obtain additional time to file. Web if the result is equal to or less than the amount on line 66 of the ia 1040, an extension is automatic. Web october 18, 2023 3:14 pm. Web connect, learn, and grow with extension and outreach. Web common questions about iowa extensions in lacerte. For most americans, filing deadlines for 2022. Web file your personal tax extension now!

Municipal Tax Extension Request Form 2007 printable pdf download

FREE 10+ Sample Lease Extension Forms in PDF Word Excel

IA Wellmark BCBS C2319221 20172021 Fill and Sign Printable Template

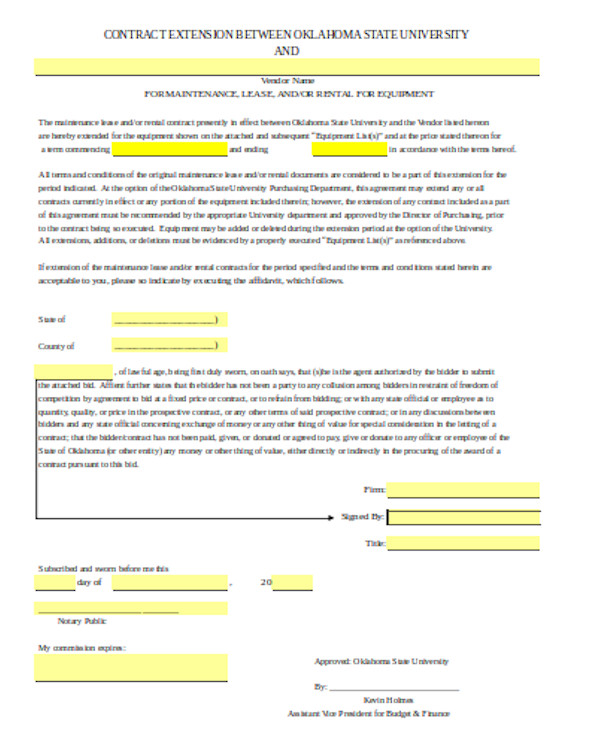

Tar contract extension form Fill out & sign online DocHub

Residential or Rental Lease Extension Agreement Iowa Form Fill Out

Iowa Form 216 Fill Out and Sign Printable PDF Template signNow

2020 Form IA DoR 1040 Fill Online, Printable, Fillable, Blank pdfFiller

Iowa W4 Form Fill Out and Sign Printable PDF Template signNow

FREE 10+ Sample Lease Extension Forms in PDF Word Excel

Form 60027 Iowa Inheritance/estate Tax Application For Extension

$5,000 X 90% = $4,500.

Use The Iowa Information Section Of Screen 9, Extensions (4868, 2350), To Override Amounts For The.

A Federal Extension Does Not Apply For Iowa Purposes.

Web $175.00 Crp 22 Maximizing Profitability On Highly Erodible Land In Iowa | Conservation Reserve Program:

Related Post: