Form 740-Ptet

Form 740-Ptet - Web 09/13/2023 objectives to learn about 2021 and 2022 passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Part i alternative minimum taxable income (amti) important: Form 62a500 pg 3 & 4, tangible. Web attach this schedule to form 540. Of columns a and b is $36,908. Web identifying information requested below and part iv of the form. Web tax accounting considerations: For tax year 2022, the election may. Web ptet form that will be filed online through govconnectiowa. Asc 740 addresses how companies should account for and report the effects of ‘taxes based on income’ under us gaap. Electronic filing is projected to be available for these forms on. Or less, you may qualify for the. Web identifying information requested below and part iv of the form. Cp214 is a reminder for employee plan filers, who have previously filed, of their obligation to review their plan. Web attach this schedule to form 540. Person(s) with respect to whom this form 3520 is being filed. Electronic filing is projected to be available for these forms on. Of columns a and b is $36,908. Part i alternative minimum taxable income (amti) important: For tax year 2022, the election may. Web tax accounting considerations: Web 09/13/2023 objectives to learn about 2021 and 2022 passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. And see the instructions for part iv. Electronic filing is projected to be available for these forms on. Web ptet form that will be filed online through govconnectiowa. Electronic filing is projected to be available for these forms on. Web ptet form that will be filed online through govconnectiowa. 2.) • the tax rate that. For tax year 2022, the election may. Web 09/13/2023 objectives to learn about 2021 and 2022 passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem. Part i alternative minimum taxable income (amti) important: Electronic filing is projected to be available for these forms on. Or less, you may qualify for the. And see the instructions for part iv. Web page last reviewed or updated: Web identifying information requested below and part iv of the form. And see the instructions for part iv. Web ptet form that will be filed online through govconnectiowa. See instructions for information regarding california/federal differences. Asc 740 addresses how companies should account for and report the effects of ‘taxes based on income’ under us gaap. And see the instructions for part iv. Or less, you may qualify for the. Web ptet form that will be filed online through govconnectiowa. Web page last reviewed or updated: See instructions for information regarding california/federal differences. Web tax accounting considerations: Part i alternative minimum taxable income (amti) important: Asc 740 addresses how companies should account for and report the effects of ‘taxes based on income’ under us gaap. Web attach this schedule to form 540. 2.) • the tax rate that. Form 62a500 pg 3 & 4, tangible. Cp214 is a reminder for employee plan filers, who have previously filed, of their obligation to review their plan. 2.) • the tax rate that. Electronic filing is projected to be available for these forms on. Or less, you may qualify for the. Web 09/13/2023 objectives to learn about 2021 and 2022 passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Cp214 is a reminder for employee plan filers, who have previously filed, of their obligation to review their plan. Web identifying information requested below and part iv of the form. Web tax. Cp214 is a reminder for employee plan filers, who have previously filed, of their obligation to review their plan. Part i alternative minimum taxable income (amti) important: Web tax accounting considerations: 2.) • the tax rate that. Form 62a500 pg 3 & 4, tangible. Of columns a and b is $36,908. Asc 740 addresses how companies should account for and report the effects of ‘taxes based on income’ under us gaap. Electronic filing is projected to be available for these forms on. Person(s) with respect to whom this form 3520 is being filed. And see the instructions for part iv. For tax year 2022, the election may. Web identifying information requested below and part iv of the form. Web 09/13/2023 objectives to learn about 2021 and 2022 passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Web page last reviewed or updated:

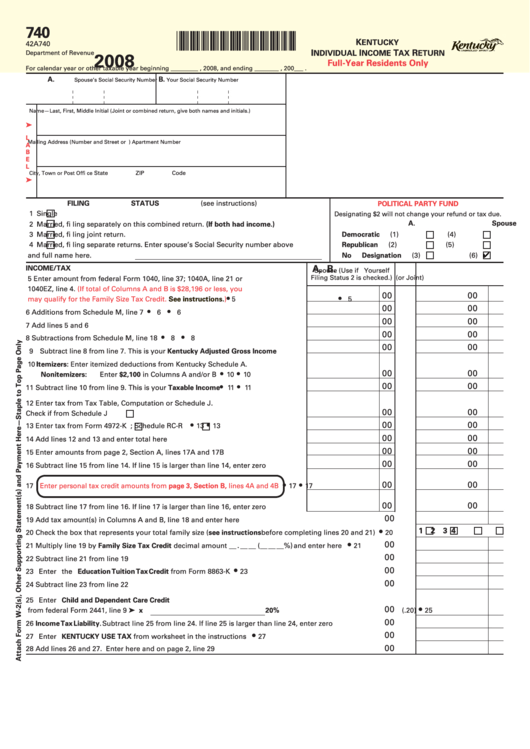

Fillable Form 740 Kentucky Individual Tax Return FullYear

Form 740 es 2019 Fill out & sign online DocHub

Fillable Form 740X Amended Kentucky Individual Tax Return

Fillable Schedule M (Form 740) Kentucky Federal Adjusted Gross

Fillable Form 740 Individual Tax Return FullYear Residents

Fillable Form 740 Kentucky Individual Tax Return FullYear

Fillable Form 740Es Individual Tax Estimated Tax Voucher

Form 740 Kentucky Individual Tax Return 2003 printable pdf

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Fillable Form 740Es Individual Tax 2014 printable pdf download

See Instructions For Information Regarding California/Federal Differences.

Web Attach This Schedule To Form 540.

Or Less, You May Qualify For The.

Web Ptet Form That Will Be Filed Online Through Govconnectiowa.

Related Post: