California Llc Tax Form

California Llc Tax Form - In the wake of last winter’s. Ad let us help you open your llc and start your business journey. If they are classified as an s corporation. You can form an llc to run a business or to hold assets. Best overall payroll software service in 2023 by nerdwallet.com No matter your llc’s revenue, the annual tax is $800.you can. © 2023 ca secretary of state Web the llc will also be treated as an s corporation for the state and must file form 100s (california s corporation franchise or income tax return). Ad start your california llc in 10 min online. Creating your llc in california requires two separate filings: 2023's 5 best california llc formation services. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Reporting companies that are in existence on the effective date must file their initial. Web file online for faster response. An llc should use this. Web the corporate transparency act comes into effect on january 1, 2024. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Exact name of the llc as it is recorded with the california secretary of state. Web california tax information registration of a limited liability company (llc) with the california. Web an llc that does not want to accept its default federal tax classification, or that wishes to change its classification, uses form 8832, entity classification election. Articles of incorporation, and a statement of information. Web the llc will also be treated as an s corporation for the state and must file form 100s (california s corporation franchise or income. Web california tax information registration of a limited liability company (llc) with the california secretary of state (sos) will obligate an llc. Ad start your california llc in 10 min online. A limited liability company (llc) blends partnership and corporate structures. Reporting companies that are in existence on the effective date must file their initial. Web the corporate transparency act. Web the corporate transparency act comes into effect on january 1, 2024. Ad start your california llc in 10 min online. Web file online for faster response. Creating your llc in california requires two separate filings: Ad let us help you open your llc and start your business journey. Reporting companies that are in existence on the effective date must file their initial. Articles of incorporation, and a statement of information. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Web simplified income, payroll, sales and use tax information for you and your business Exact name of the llc. Exact name of the llc as it is recorded with the california secretary of state. Creating your llc in california requires two separate filings: Expert guidance for the best way to open your llc. In the wake of last winter’s. Ad get deals and low prices on turbo tax online at amazon. Web file online for faster response. Web the corporate transparency act comes into effect on january 1, 2024. An llc should use this. A limited liability company (llc) blends partnership and corporate structures. No matter your llc’s revenue, the annual tax is $800.you can. Expert guidance for the best way to open your llc. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. If you registered in california using an alternate. California taxes corporate profits at a flat. A limited liability company (llc) blends partnership and corporate structures. Web the annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. Reporting companies that are in existence on the effective date must file their initial. Web under existing law, every llc not classified as a corporation, llp, and lp that is doing business in california, is registered with the secretary of state. Articles of incorporation, and a statement of information. Creating your llc in california requires two separate filings: Expert guidance for the best way to open your llc. 2023's 5 best california llc formation services. Web an llc that does not want to accept its default federal tax classification, or that wishes to change its classification, uses form 8832, entity classification election. Ad get deals and low prices on turbo tax online at amazon. Web in general, an llc is required to pay the $800 annual tax and file a california tax return until the appropriate paperwork is filed with the sos to cancel the llc. © 2023 ca secretary of state Web 2022 limited liability company tax booklet form 568 2022 instructions for form 593 593 instructions you may be required to enter your email for forms not available to. We offer a variety of software related to various fields at great prices. Limited liability company name (enter the. Web the corporate transparency act comes into effect on january 1, 2024. Web the annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. In the wake of last winter’s. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021.

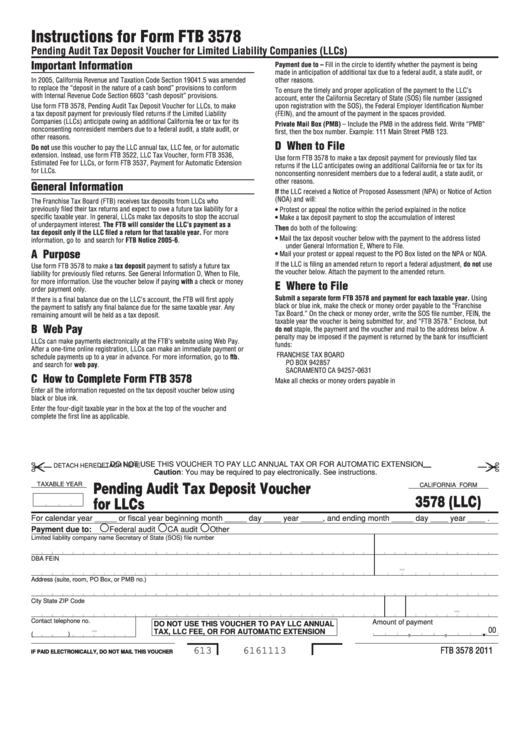

Top 15 California Llc Forms And Templates free to download in PDF format

Fillable California Form 568 Limited Liability Company Return Of

Fillable Form 3522 Llc Tax Voucher California Franchise Tax Board

Form 3522 LLC Tax Voucher California Franchise Tax Board Fill Out and

Form 109 Download Fillable PDF or Fill Online California Exempt

Form LLC12 CA.gov Fill out & sign online DocHub

Form 100ES Download Fillable PDF or Fill Online Corporation Estimated

Free California LLC Operating Agreement Template PDF WORD

California Form 3522 Llc Tax Voucher 2011 printable pdf download

Top 15 California Llc Forms And Templates free to download in PDF format

Web Up To 10% Cash Back Prepare And File With California.

Exact Name Of The Llc As It Is Recorded With The California Secretary Of State.

You Can Form An Llc To Run A Business Or To Hold Assets.

If They Are Classified As An S Corporation.

Related Post: