Alabama Form 20C

Alabama Form 20C - The federal form 7004 must be submitted with the form 20c or. An alabama consolidated return means an alabama corporate. Link to official form info for 20c. Web link to official form info: Web an aag, alabama affiliated group, may elect to file an alabama consolidated return. Web alabama form 20c is a document that must be completed by any taxpayer who has sold or exchanged property located in alabama. Authorization for access to third party records by alabama department of revenue employees. Navigate to the alabama tax authority. Web we last updated alabama form 20c in february 2023 from the alabama department of revenue. Web we last updated the alabama corporation income tax return in february 2023, so this is the latest version of form 20c, fully updated for tax year 2022. Corporation operating only in alabama. Web once completed you can sign your fillable form or send for signing. Navigate to the alabama tax authority. Web alabama mandates an electronic form of payment when you electronically file forms 20c, 20cc, 20s and ptec. Web an aag, alabama affiliated group, may elect to file an alabama consolidated return. Web the taxpayer must submit form 2220al and the federal form 2220 with the return (form 20c) when filed to compute the required payment and penalty. Web link to official form info: Web once completed you can sign your fillable form or send for signing. The federal form 7004 must be submitted with the form 20c or. Web form 20c,. An alabama consolidated return means an alabama corporate. Corporation operating only in alabama. The form is used to report the gain or loss from. Web form 20c, but should be maintained and available upon request. 20c *2100012c* corporation income tax return (state. An alabama consolidated return means an alabama corporate. Web the taxpayer must submit form 2220al and the federal form 2220 with the return (form 20c) when filed to compute the required payment and penalty. Ad uslegalforms.com has been visited by 100k+ users in the past month Web to generate only form 20c, do the following: Web an aag, alabama affiliated. File the 2022 return for calendar year, fiscal year or short year that begins in. 20c *2100012c* corporation income tax return (state. Web we last updated the alabama corporation income tax return in february 2023, so this is the latest version of form 20c, fully updated for tax year 2022. This form is for income earned in tax year 2022,. File the 2022 return for calendar year, fiscal year or short year that begins in. Web if an extension has been granted for federal purposes, the extension is also granted for alabama purposes; Web state comptroller's office state of alabama, dept. Navigate to the alabama tax authority. Corporation operating only in alabama. Web date qualified in alabama nature of business in alabama • • filing status: Web we last updated the alabama corporation income tax return in february 2023, so this is the latest version of form 20c, fully updated for tax year 2022. The federal form 7004 must be submitted with the form 20c or. Navigate to the alabama tax authority.. Web the taxpayer must submit form 2220al and the federal form 2220 with the return (form 20c) when filed to compute the required payment and penalty. Link to official form info for 20c. An alabama consolidated return means an alabama corporate. Web alabama mandates an electronic form of payment when you electronically file forms 20c, 20cc, 20s and ptec. 20c. Corporation operating only in alabama. The form is used to report the gain or loss from. Web date qualified in alabama nature of business in alabama • • filing status: Authorization for access to third party records by alabama department of revenue employees. Web we last updated the alabama corporation income tax return in february 2023, so this is the. Link to official form info for 20c. Web to generate only form 20c, do the following: You can pay via electronic funds withdrawal (direct debit) or. Web if an extension has been granted for federal purposes, the extension is also granted for alabama purposes; Web state comptroller's office state of alabama, dept. Web alabama mandates an electronic form of payment when you electronically file forms 20c, 20cc, 20s and ptec. Corporation operating only in alabama. Ad uslegalforms.com has been visited by 100k+ users in the past month Link to official form info for 20c. Web state comptroller's office state of alabama, dept. The federal form 7004 must be submitted with the form 20c or. The form is used to report the gain or loss from. All forms are printable and downloadable. Navigate to the alabama tax authority. Web once completed you can sign your fillable form or send for signing. Web alabama form 20c is a document that must be completed by any taxpayer who has sold or exchanged property located in alabama. An alabama consolidated return means an alabama corporate. This form is for income earned in tax year 2022, with tax returns due in april. Web date qualified in alabama nature of business in alabama • • filing status: 20c *2100012c* corporation income tax return (state. Web the taxpayer must submit form 2220al and the federal form 2220 with the return (form 20c) when filed to compute the required payment and penalty.

Alabama Form Uc Cr4 Pdf 20202022 Fill and Sign Printable Template Online

Alabama Insurance License Lookup / Mandatory Liability Insurance

Writ To Execute Birmingham Al Alabama Fill Online, Printable

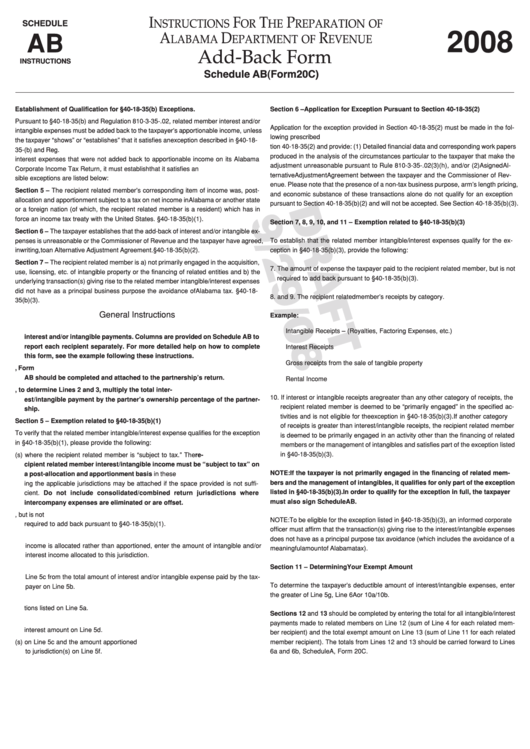

Download Instructions for Form 20C Corporation Tax Return PDF

Download Instructions for Form 20C Corporation Tax Return PDF

Fillable Form 20cC Alabama Consolidated Corporate Tax Return

Fillable Form 20cAagis Alabama Affiliated Group Spreadsheet

Form 20c Schedule Ab Draft AddBack Form 2008 printable pdf download

Fillable Schedule Ab (Form 20c) Alabama AddBack Form 2014

Fillable Form 20c Alabama Corporation Tax Return 2014

Web An Aag, Alabama Affiliated Group, May Elect To File An Alabama Consolidated Return.

Web Link To Official Form Info:

Application To Become A Bulk Filer.

You Can Pay Via Electronic Funds Withdrawal (Direct Debit) Or.

Related Post: